Tom Yeung here with the Sunday Digest.

In mid-2019, the U.S. Federal Reserve began cutting interest rates for the first time since the 2007-’08 global financial crisis. The U.S. economy was beginning to slow, and economists were worried that trade disputes and weak global growth could send America into a recession. The COVID-19 pandemic the following year turned those fears into a reality.

Now, you might imagine that the large blue-chip stocks of the Dow Jones Industrial Average might have done well during this period. Companies like Microsoft Corp. (MSFT), Apple Inc. (AAPL), and Walt Disney Co. (DIS) represented some of the most stable, high-earning companies in America. Surely, they as a group should weather the storm?

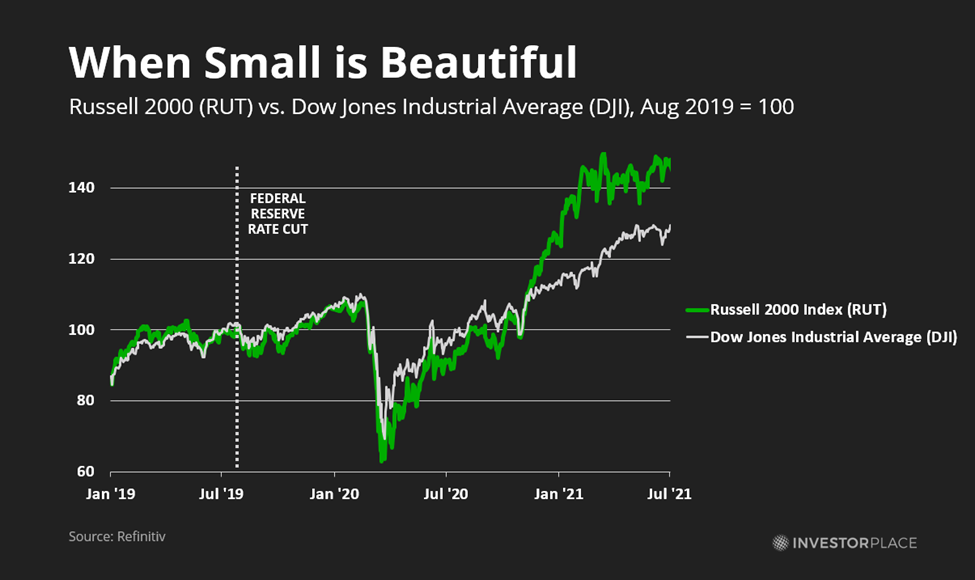

But the opposite happened. Over the following two years, smaller firms would trounce these larger enterprises. The Russell 2000 index, a measure of 2,000 small U.S. companies, rose 34% over this period, versus a 19% gain in the Dow Jones.

Many individual firms did even better. Solar firm Enphase Energy Inc. (ENPH) saw shares rise 6X… mobile advertising platform Digital Turbine Inc (APPS) jumped 10X… and vaccine maker Novavax Inc. (NVAX) saw an incredible 40X surge in prices.

A similar pattern also happened after rate cuts in mid-2007. The Russell 2000 took just over three years to regain price levels from that period. The Dow Jones Index took an additional 16 months to achieve that same feat, while the S&P 500 index of large U.S. stocks needed another six months after that.

That’s because smaller stocks have far greater upside potential, which they often see when economies move into recovery mode. These firms can rise 3X… 5X… or more when interest rates decline, recession fears fade away, and consumer confidence returns.

In fact, InvestorPlace Senior Analyst Luke Lango will be presenting a company tomorrow, during a 10 a.m. Eastern broadcast, that he believes can rise 20-fold over the next several years. Elon Musk is set to reveal his “robotaxi” later this week, and according to Luke, that could help send shares of this little-known supplier skyrocketing. You can reserve your spot for Luke’s event by clicking here.

Until then, I’d like to share three other small-cap stocks that also could do well as the Federal Reserve continues this latest round of interest rate cuts…

Small-Cap Move for 2025 No. 1: The Automation Play

At midnight last Tuesday, the International Longshoremen’s Association (ILA) began its strike at 36 ports spanning the U.S. East and Gulf Coasts. Much of their demands had to do with wages – their hourly pay lagged behind the nearly $55 an hour that West Coast dockworkers enjoy.

But as InvestorPlace Senior Analyst Louis Navellier points out this week, an even bigger reason is about job security from artificial intelligence-powered robotic automation.

The dockworkers are worried about the ports getting automated and losing their jobs in the long term. And reports indicate they want assurances that there will be a total ban on automation.

In other words, no robots when it comes to loading and unloading freight. That includes cranes, gates and moving containers.

Unfortunately, I’ve got bad news for these folks.

Automation and AI are coming whether they like it or not. The proverbial horse has left the barn.

That’s because AI is quickly becoming smart enough to run without human intervention. Companies from ABB Ltd. (ABBNY) to Symbotic Inc. (SYM) are pushing the envelope in logistics-related AI, and worker unions know that AI is coming for their jobs. Shares of these companies are sky-high as a result, reducing the upside of these mid- and large-cap firms.

One overlooked area, however, is government-related work. In particular, one automation firm is seeking to streamline the way Transportation Security Agency (TSA) agents handle the millions of travelers that pass through airport security and other checkpoints every year: Evolv Technologies Holdings Inc. (EVLV).

The $600 million Boston-based firm is a small-cap company focused on using AI to scan people for firearms and other concealed weapons. People simply walk through Evolv’s gates armed with millimeter-wave technology, and AI does the rest. Suspicious items are “red-boxed” for further investigation, while everyone else continues through.

One key benefit of Evolv’s system is that users don’t have to remove items from their pockets. That means the system can scan through people 10X faster than traditional methods while requiring fewer people to operate scanning machinery. The company already has thousands of paying customers (including stadium owners and schools), and the TSA is currently testing the system in at least one U.S. airport.

Best of all, shares of Evolv are still cheap for a company that’s set to become profitable within three years. Its small size leaves 5X or more upside if TSA trials go well.

Small-Cap Move for 2025 No. 2: The Biggest Smallest Loser

This week, Louis additionally revealed one of his top picks for risk-adjusted returns: Eli Lilly and Co. (LLY). He says:

Eli Lilly is a well-known drug manufacturer, developing more than 100 drugs in its more than 147-year history.

Most recently, the company has benefited from increased demand for its diabetes and weight-loss treatments – Mounjaro and Zepbound. In fact, surging demand for these treatments led to a 36% jump in total revenue in its second quarter. Eli Lilly is a great risk-adjusted pick because it is a low-risk stock.

The GLP-1 weight-loss drug category could see as much as $170 billion in sales by 2030, and Eli Lilly will receive a significant chunk of this new spending thanks to its significant head start.

However, it’s important to note that Louis carefully says “risk-adjusted returns,” because Lilly’s large size makes future gains increasingly difficult. An additional $10 billion in sales might only warrant another $100 billion in market capitalization… which translates into *only* a 12% gain.

That’s why it’s worthwhile to consider fiver smaller firms that are vying for a place at the table:

- Viking Therapeutics Inc. (VKTX). The San Diego-based company is one of the fastest-moving competitors in the GLP-1 space. The company completed its Phase 2 trials of its flagship weight-loss drug in February, and could begin its Phase 3 trials as soon as early 2025. William Blair analyst Andy Hsieh notes this “torrid” pace should push the drug candidate from early- to late-stage development in roughly three years. The market values the firm at $7.2 billion.

- Zealand Pharma A/S (ZLDPF). The Danish biotech research firm is also hot on the heels of Eli Lilly. The firm has one candidate in Phase 3 trials (data is due in late 2025) and another two in Phase 2 trials. That makes it the most valuable of these small-cap biotech companies ($8.6 billion market cap), making it a safer, but lower-upside bet.

- Structure Therapeutics Inc. (GPCR). The $2.4 billion firm is focusing on oral-based weight-loss drugs as an alternative to current injection-based ones. Though Phase 2 data isn’t due until late 2025 (which will push Phase 3 results into 2027), Structure is widely considered to have the second-most-advanced oral product in development, making it a tempting buy-out target for companies seeking to compete against the oral semaglutide product from Novo Nordisk A/S (NOVO).

- Altimmune Inc. (ALT). The $400 million firm is concluding Phase 2 trials of its GLP candidate, Pemvidutide, and will soon begin Phase 3 trials. Mean weight loss in early 48-week trials were slightly less (15.6%) than those seen with newer GLP-1 drugs like tirzepatide (20% to 25%), but still greater than first-generation versions like semaglutide (10% to 15%).

- Terns Pharmaceuticals Inc. (TERN). Finally, this $700 million firm is the furthest behind (with drugs only in Phase 1 trials), but offers one of the more diversified pipelines. The company is experimenting with three separate mechanisms to tackle obesity, two of which are non-GLP related. That could mean these drugs will work on candidates where GLP-1 drugs do not.

These companies offer an alternative to Eli Lilly and its main rival, Novo Nordisk – mega-cap pharmaceutical companies that have existing weight-loss drugs on the market. The startups are higher risk… but also come with significantly greater upside.

Of course, we won’t know which company will eventually succeed. Clinical trials often produce unpredictable results, and it’s well known that fewer than 15% of drugs selected for clinical trials ever make it into production. That’s why I’d recommend treating these five upstarts as a single investment and put equal amounts in each one.

Small-Cap Move for 2025 No. 3: A Bet on Nuclear

Finally, Luke writes this week that red-hot nuclear stocks could easily make you rich:

Last week, Microsoft (MSFT) tapped utility provider Constellation Energy (CEG) to restart the long-dormant Three Mile Island nuclear power plant.

As part of the deal, the two will reopen the plant. And for the next 20 years, Microsoft will buy all the energy that the plant produces to help power its AI data centers.

Clearly, Microsoft believes that nuclear energy is safe – and that it’s critical to help support the AI Boom.

The most blue-chip of the nuclear “pure plays” out there is Cameco Corp. (CCJ), a dominant uranium miner that also holds a 49% stake in nuclear power plant maker Westinghouse. Its $21 billion market capitalization, however, reduces potential upside. The same is true for $11 billion BWX Technologies Inc. (BWXT). Meanwhile, $2.9 billion NuScale Power Corp. (SMR) has far greater upside, but is currently being investigated by the Securities and Exchange Commission for potential whistleblower suppression – an allegation management initially denied, before eventually confirming. (That makes SMR particularly speculative!)

That leaves uranium exploration companies.

My top pick here is Uranium Energy Corp. (UEC), a $2 billion company with two extraction-ready projects in South Texas and Wyoming, and another seven projects in its pipeline.

The company could be sitting on as much as 100 million pounds of uranium reserves, and insiders have recently been buying significant numbers of shares – a typically bullish sign. Also, analysts have boosted their 2027 revenue estimates by 15% on rising uranium prices, and profits are now expected as early as next year.

Though smaller uranium miners exist, UEC offers a better blend of existing projects and potential upside than its peers.

The Small-Cap Self-Driving Stock

On October 10, Elon Musk will headline his electric vehicle company’s “Robotaxi Day.” Wedbush Securities tech analyst Dan Ives calls the event nothing short of a “linchpin day for the Tesla story.”

The stakes couldn’t be higher. Tesla year-to-date sales remain 2% below their levels a year ago, and competition among EV makers is heating up. U.S. News & World Report counts no fewer than 65 EV models due to be released over the next several years, including exciting entrants like the Chevrolet Camaro EV and an all-electric Ferrari.

Tesla needs a new game-changing product to stay ahead. And Musk seems to be betting on a self-driving robotaxi called the “Cybercab.”

Fortunately, Luke believes he’s identified an even better play than Tesla. This small-cap company could become a supplier to the automaker, and its small size gives it as much as 20X upside from current prices.

To learn more about this pick, click here to sign up for Luke’s presentation, where he will reveal how to get the name of this potential home run of a stock. That broadcast is scheduled for tomorrow morning at 10 a.m. Eastern, so you less than 24 hours to make sure you’re one of the first in line to get that. Click here for more details and to save your seat.

Until next week,

Tom Yeung

Market Analyst, InvestorPlace