For months now, we’ve suspected that interest rate cuts would arrive by the end of summer. And with the central bank poised to cut just days from now – this coming Wednesday, Sept. 18 – it seems that forecast is proving correct.

But it’s not just rate cuts we’re anticipating here. We expect that the Fed’s rate-cutting cycle will reinvigorate our weakened economy – and consequently, kickstart a long-lasting rally in stocks.

Last week, we looked to historical precedent in support of this theory – the 1995 rate-cutting cycle.

That era is a close parallel to the economic backdrop that we have today. And when the Fed began cutting rates at that time, it helped to fuel a huge multi-year stock rally.

Today we’ll consider two other comparable cycles – and more evidence supporting our theory that stocks are about to go nuts.

History Shows the Fed Will Open the Flood Gates

Back in September 1998, the Federal Reserve began a proactive rate-cutting cycle while the economy was still broadly healthy. GDP was running around 5%. Jobless claims measured about 290,000. The U.S. was experiencing healthy economic growth and relatively low joblessness.

Today, we have a very similar setup. GDP is running at about 3%, and jobless claims are around 230,000. Indeed, as was the case in late summer 1998, we currently have good economic growth and relatively low joblessness.

Those rate cuts back in 1998 sparked a huge stock market rally. From the first cut in September 1998 into early 2000, the S&P 500 rose about 30%, while the Nasdaq soared around 175%.

1998’s ‘good’ rate-cut cycle helped spark a huge, multi-year stock market rally, especially in tech stocks.

But, of course, this wasn’t a one-off situation.

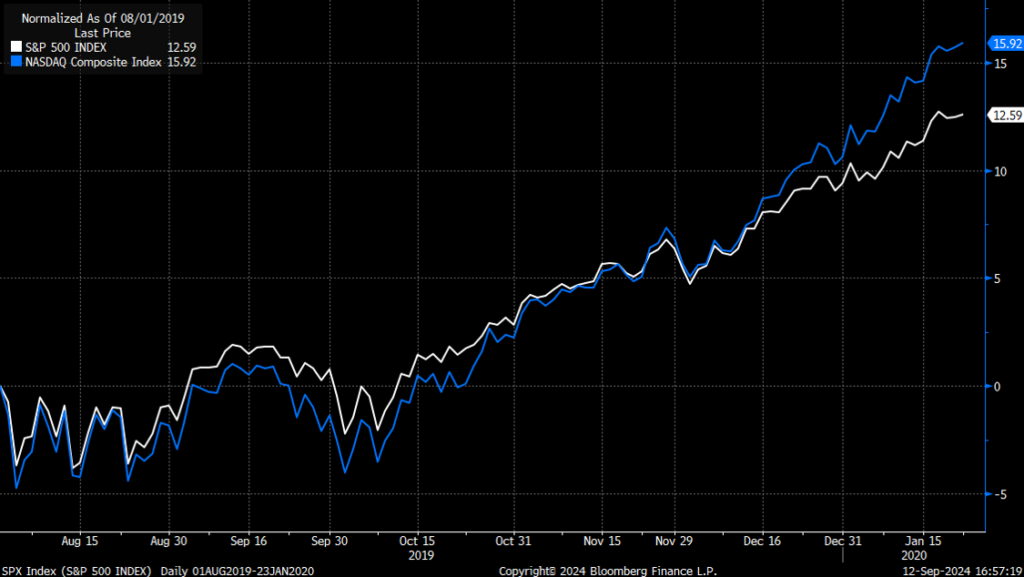

Back in August 2019, the Federal Reserve began another proactive rate-cutting cycle while the economy was still broadly healthy. GDP was running around 3.4%, while jobless claims measured about 215,000. Again, we had good economic growth and relatively low joblessness – as we do today.

And needless to say, those 2019 rate cuts sparked a huge stock market rally. From the first rate cut in late summer 2019 into early 2020, both the S&P 500 and Nasdaq rose about 15%.

We think that rally would’ve lasted for longer – and produced bigger gains – if it weren’t for the exogenous shock of the COVID-19 pandemic in early 2020.

Though, regardless, the point stands: 2019’s rate-cut cycle helped spark a big rally in stocks.

We think a similarly ‘good’ rate-cut cycle will start in just a few days.

The Final Word on Incoming Rate Cuts

When the Fed does embark on its rate-cutting journey, it should help spark a similar, multi-year stock market rally that lasts into 2025 and 2026. And we think AI/tech stocks will be the market’s biggest winners in that time.

As such, we believe now is a great time to get positioned for a major incoming rally.

Though, of course, as is true for most market rallies, some stocks will soar much higher than others.

That’s why, just this past Wednesday, Sept. 11, I held an important strategy session to discuss what’s ahead for investors. And I unveiled what I believe is one of the best investment strategies to capitalize on a potential major market reversal.

Thankfully, it’s not too late to catch the replay!

Learn how to get best positioned for a new era of stock gains… before the Fed makes its move.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.